A Step-by-Step Guide to Online Business Research

Purpose of this guide

The commercialization of the Internet and the World Wide Web during the mid to late 1990s and early 2000s resulted in an explosion of easily available real-time information that can be used to stay up-to-date on the latest trends and opportunities, analyze the business model for your current company, develop a business plan for a new venture, and more. While online information is never a substitute for first-hand experience or discussions with customers and experts, the data available on the Internet are nonetheless a valuable resource for analyzing industry structure and trends, estimating market size, analyzing competitor positioning, obtaining macroeconomic data on a country you wish to enter, and a broad range of other topics.

This tool provides tips for how to search online for information to support business analysis and decision-making, and includes lists of sources where this information can be found. These sources include websites that are free to the public, as well as premium resources which can be licensed at a cost.

A step-by-step approach to finding and using online information is presented below. More in-depth research guides are then presented. These guides, organized by research area, provide specific starting points where you can find information to analyze a current business or industry, start a new business, perform a country analysis, find resources (e.g., business advisors, talent), and more.

Types of research: Primary versus Secondary

Market research typically involves two kinds of research:

- Primary research (also known as field research) involves direct involvement in the data collection process

- Secondary research (also known as desk research) relies on the analysis of existing data and research materials

The distinguishing factor between primary research and secondary research is the degree of involvement of the research with the data gathering process.

Primary research

Primary research involves direct participation in the data collection process. For market research, it involves going directly to a source - usually customers or prospective customers in your target market - to ask questions and gather information.

Examples of primary research include:

- Interviews (telephone or face-to-face)

- Surveys (online or mail)

- Questionnaires (online or mail)

- Focus groups

- Visits to competitors’ locations

When you conduct primary research, you’re typically gathering two basic kinds of information:

- Exploratory: This research is general and open-ended, and typically involves lengthy interviews with an individual or small group

- Specific: This research is more precise, and is used to solve a problem identified in exploratory research. It involves more structured, formal interviews.

Primary research usually costs more and often takes longer to conduct than secondary research, but gives conclusive results.

Advantages of primary research include:

- Gives the researcher ownership of the research data (which can be useful in competitive markets)

- Researcher can verify authenticity and quality of the data due to active participation in the data collection process

Secondary research

Secondary research is a type of research that has already been compiled, gathered, organized, and published by others (i.e., it relies on the analysis of already acquired information). It includes reports and studies by government agencies, trade associations, or other businesses in your industry.

Data for secondary research can be accesses from various sources including:

- The internet

- Libraries

- Educational Institutions

- Organizational Reports

Advantages of Secondary Research include:

- Less time-consuming and can be completed with limited resources

- Helps prevent knowledge repetition by mapping out already existing research efforts (no need to collect the data if it already exists)

General procedure for conducting online research

Part 1: Focus your research goals

- Determine the purpose of your research. For example:

- Staying up-to-date with the latest industry news and trends

- Looking for specific information (e.g., market size projections, competitive positioning of key players in your industry, company information and ratios)

- Identify the information you need and what you will do with the information once you find it. For example:

- Preparing a business plan or pitch for a new venture

- Analyzing a new opportunity

- Deciding whether to enter a new market

- Conducting a strategic review of your business model

| Why? |

|

| What? |

|

| Who? |

|

| How? |

|

| When? |

|

| Where? |

|

| Assumptions? |

|

Part 2: Identify sources of information

- Based on the purpose of your research and type of information you need, identify sources you can use to find the information you need

(E.g., if you are trying to identify potential competitors and understand their financial performance, Guides 2, 4 and 5 will probably be most useful to you. If you are interested in the latest news on a new technology, Guide 1 will be most helpful)

- As you search, keep track of where you find each piece of information and how you got there, including any search keywords you used

Guides organized by research goal

Guide 1: Examine trends and disruptors

When you want to keep up with news and trends, packages market research reports can be useful but they are expensive, quickly out-of-date, and don't always cover new developments. Instead, use the resources suggested below to broaden your approach.

| Why |

|

| What |

|

| Where (Free resources) |

|

Guide 2: Analyze an industry

| Why |

|

| What |

|

| Who |

|

| Where (Free resources) |

|

Guide 3: Research a market

| Why |

|

| What |

|

| Where (Free resources) |

|

Guide 4: Analyze a company

| Why |

|

| What |

|

| Where (Free resources) |

|

Guide 5: Value a company

| Why |

|

| What |

|

| How |

|

| Where (Free resources) |

|

Guide 6: Analyze a country or region

| When |

|

| What |

|

| How |

|

| Where (Free resources) |

|

Guide 7: Launch a New Venture

| When |

|

| What |

|

| Where (Free resources) |

|

Free Databases

| Resource Name | URL |

|---|---|

| Bureau of Labor Statistics | http://www.bls.gov/home.htm |

| Census Bureau | http://www.census.gov |

| Census Business Builder: Small Business Edition | http://www.census.gov/data/data-tools/cbb.html |

| CIA World Factbook | http://www.cia.gov/library/publications/the-world-factbook/index.html |

| Crunchbase | http://www.crunchbase.com |

| Doing Business | http://www.doingbusiness.org/ |

| Export.gov | http://www.export.gov/ |

| GlobalEdge | http://globaledge.msu.edu |

| IMF Article IV Staff Reports | http://www.imf.org/external/country |

| International Economic Statistics | http://fred.stlouisfed.org/categories/32263 |

| International Statistical Agencies | http://www.census.gov/progrmas-surveys/international-programs/about/related-sites.html |

| http://www.linkedin.com | |

| NAICS | http://www.naics.com/search.htm http://www.census.gov/eos/www/naics |

| National Venture Capital Association (NVCA) | http://www.nvca.org/ |

| NYT Dealbook | http://www.dealbook.nytimes.com/ |

| PwC MoneyTree reports | http://www.pwc.com/us/en/industries/technology/moneytree.html |

| SEC EDGAR | http://www.sec.gov/edgar/searchededgar/companysearch.html |

| Small Business Administration (SBA) | http://www.advocacy.sba.gov/category/research |

| Think Tank Search | http://www.guides.library.harvard.edu/c.php?g=310680&p=2072552 |

| Trade Show News Network | http://www.tsnn.com |

| UN Comtrade | http://www.comtrade.un.org/db/ |

| UN Statistics Division | http://unstats.un.org/ |

| US Statistics | http://www.usa.gov/statistics |

| World Bank Data Bank | https://databank.worldbank.org/data/home.aspx |

| World Federation of Exchanges | http://www.world-exchanges.org/ |

Hints and Tips

- Some resources use the North American Industry Classification System (NAICS)

- Researching a company that is small, new, or privately-held can be challenging

- You may be able to find information about the company or their products on their website, social networking sites like LinkedIn, and startup resources like Crunchbase

- These sites are free and may rely on users to supply data, so the information is not guaranteed to be correct or up-to-date

- Caution on using free sources

- While free information from publicly available sources can be extremely useful, it is important to remember that this information has not been validated by a neutral third-party information provider and may not always be accurate

- The following questions may help you determine the validity of free Web content:

- What type of individual or organization produced the site? Is there a bias or commercial

interest? Who is the website’s target audience? - Is an author listed? If so, what credentials does this author have?

- How current is the website and the information on it?

- Are references, citations, or links to other resources included?

- Can you confirm the information with a second, independent source?

- What type of individual or organization produced the site? Is there a bias or commercial

- Make sure you leverage the full power of Google Search (to learn how to do this, check out Harvard's free guide). This includes

Library resources

Prominent business school library guides and knowledge bases are a hidden gem and can often be very useful resources or starting points for conducting business research (e.g., understanding the difference between market reports and industry reports).

Some of my personal favorites include:

- Stanford GSB - Knowledge Base

- UBC - Industry Guides for Secondary Market Research

- UWO Library - Business Databases by Subject

- MIT Library - Business Resources

- Harvard Library - Databases Search Engine

Other potentially useful university library guides include:

USA

Canada

Business

- University of Toronto Library - Market research guide

- UBC Library - The beginner’s guide to business research

- Wharton - MBA business research overview

- Harvard Law School Library - Company, Industry & Market Research

- UWO - Business research guides

- University of Toronto Library - Business and management research guides

- Harvard Business School Library - Guides

- Stanford GSB - Research guides

- Oxford Bodleian Libraries - Business and management “getting started”

- Lippincott Library of the Wharton School - Guides

General

Notes Dump

I've created some personal notes for myself while conducting research for this guide. I've dumped the notes here in case they might be any help to someone.

Scholar's Guide to Google

Source: https://guides.library.harvard.edu/googleguide

- Caution should be used when using Google for research

- Web sites are often unstable, unscholarly, and a poor substitute for library collections or subscription electronic resources

- Nevertheless, there are a growing number of legitimate research guides, full-text collections, and other scholarly tools on the free Web worth exploring

- The challenge with billions of indexed sites is finding the right ones

- There are a number of search techniques that researchers can use to use to refine their search techniques

Google Web

Advanced Searching (Tips on conducting advanced web searches using Google, including using operators not readily available from the Advanced Search Page)

- Google users can conduct advanced searches in two ways:

- By using the search engine's dedicated Advanced Search page

- By integrating Advanced Search Operators into their search

Advanced Search Page

- Google’s Advanced Search screen allows researchers an easy way to refine a query by filling in special fields or using a series of pull-down menus

- Users can find results containing all of their search terms, an exact phrase, at least one of their search words, or without specified words, simply by filling in the appropriate text boxes

- In addition, users can use the Advanced Search page to limit their search by Language, File Format (Ex. .pdf, .ps, .doc, .xls, .ppt, .rtf), Date (Ex. only return web pages updated in the last 3 months, 6 months or year), Occurences (Ex. only return results where the search terms occur in the title, text, URL, etc.), Domain (Ex. only return results from a particular site or domain that you select), Similar (Ex. find pages similar to the page you specify), or Links (Ex. find pages that link to the page you specify).

Alternate Query Types

-

Some special queries NOT readily available through the Advanced Search Page are listed below

-

cache: The query [cache:] will show the version of the web page that Google has in its cache.

- For instance, the search above will show Google's cache of Harvard's main homepage. Note there can be no space between the "cache:" and the web page url. If you include other words in the query, Google will highlight those words within the cached document. For instance, [cache:www.harvard.edu college] will show the cached content with the word "college" highlighted. This functionality is also accessible by clicking on the "Cached" link on Google's main results page.

-

info: The query [info:] will present some information that Google has about that web page. For instance, [info:www.harvard.edu] will show information about the Harvard homepage. Note there can be no space between the "info:" and the web page url. This functionality is also accessible by typing the web page url directly into a Google search box.

-

define: The query [define:] will provide a definition of the words you enter after it, gathered from various online sources. The definition will be for the entire phrase entered (i.e., it will include all the words in the exact order you typed them).

-

intitle: If you include [intitle:] in your query, Google will restrict the results to documents containing that word in the title. For instance, [intitle:harvard biology] will return documents that mention the word "harvard" in their title, and mention the word "biology" anywhere in the document (title or no). Note there can be no space between the "intitle:" and the following word.

- Putting [intitle:] in front of every word in your query is equivalent to putting [allintitle:] at the front of your query:

-

inurl: If you include [inurl:] in your query, Google will restrict the results to documents containing that word in the url. For instance, [inurl:harvard biology] will return documents that mention the word "harvard" in the url, and mention the word "biology" anywhere in the document (url or no). Note there can be no space between the "inurl:" and the following word.

- Putting [inurl:] in front of every word in your query is equivalent to putting [allinurl:] at the front of your query:

How Google Works (A brief description of Google's "special sauce" (i.e., how they rank web pages)

Google, like many other search engines today, has moved beyond simply counting the number of times a term appears on a Web page (or in its metadata) in order to determine its relative "rank" in the results set. Instead, it examines all aspects of a page's content (as well as the content of the web sites that link to it) using sophisticated text-matching techniques. Google's PageRank system also determines a site’s relative standing by taking into account the following:

- the number of links to the Web page from other (external) sites

- the relative “importance” of the sites making the link.

Harvard researchers should understand that some scholarly and highly relevant Web pages may appear further down the Google results list, not because they are less scholarly or relevant, but simply because others have outranked them in terms of keywords and referral links. Scholars should also be aware that Google runs search relevant ads above and next to their official results.

10 Quick Search Tips (From "Avoiding Stop Words" to "Boolean Basics," these tips will help you to hone in quickly on your research topic!)

-

Avoid Stop Words

The more stop words in your query (such as adverbs, conjunctions, prepositions, or forms of "be"), the less likely your results will include what you're looking for. -

Boolean Basics

The Boolean AND command is automatically implied in ALL Google searches. Boolean OR must be in all capital letters, or else google will simply ignore it. Boolean NOT is the minus sign "-" and must be in front of each word you want to exclude. -

No Case Sensitivity

Google searches are not case sensitive. All letters, regardless of how you enter them, are understood as lower case. For example, searches for "george washington," "George Washington," and "George washington" all return the same results. -

Use Quotes

You can force Google to look for words in the exact order you type them in by putting quotes around the words in your search. -

Restrict Domain

In order to help you find quality hits, you might want to restrict your search only to Web sites at government or educational institutions. You can do this by typing in your search and then the word site: [remember the colon] and then the domain. -

Don't Assume Singular/Plural Included

Google improves its results by ONLY looking at the form of the word that you type in. If you type in the word "cake," it won't necessarily find the word "cakes." Be precise when searching and use the appropriate Boolean command when necessary. -

No Truncation, But...

No user-defined truncation is allowed in Google. Instead, the search engine automatically uses its "stemming" technology. When appropriate, it will search not only for your search terms, but also for words that are similar to some or all of those terms. For specific truncation needs, use a series of searches and the Boolean operators. -

How to Search Using Common Words

Google generally ignores common words and characters such as "this," "where," "how", as well as certain single digits and single letters. It will indicate if a common word has been excluded by displaying details on the results page below the search box. If a common word is essential to your search, you can include it by putting a "+" sign in front of it (be sure to include a space before the "+" sign) or put quotation marks around two or more words. Ex. "where are you" -

This NOT That

You can exclude a word from your search by putting a minus sign ("-") immediately in front of the term you want to avoid. (Be sure to include a space before the minus sign.) This can be useful when you are searching for a term that has more than one meaning; "apple" can refer to the fruit or the computer company. To find web pages about apple that do not contain the word "computer", type. -

Searching Synonyms

You may want to search not only for a particular keyword, but also for its synonyms. Indicate a search for both by placing the tilde sign ("~") immediately in front of the keyword. For example, to search for food facts as well as nutrition and cooking information, use: ~food ~facts

Google Book Search

- Allows you to search the full text of scanned books (contributed by libraries and publishers) via the Web, and to read selections or the full text of these digitized texts

- Different libraries have different versions of Google Book Search (e.g., Harvard has its own version of Google Book Search provided through the E-Research at Harvard Libraries site)

- You can connect to Google Book Search without going through a library web site but will not have access to the full text materials licensed through that library (e.g., Harvard Library)

- Has both basic and advanced search functions similar to Google’s Web search interface

- Simply enter keywords related to the book(s) you are searching for (such as author, title, subject, ISBN, etc.) and click on "Search Books.”

- The same 10 Quick Search Tips listed earlier apply for searching the Web and Google Book Search

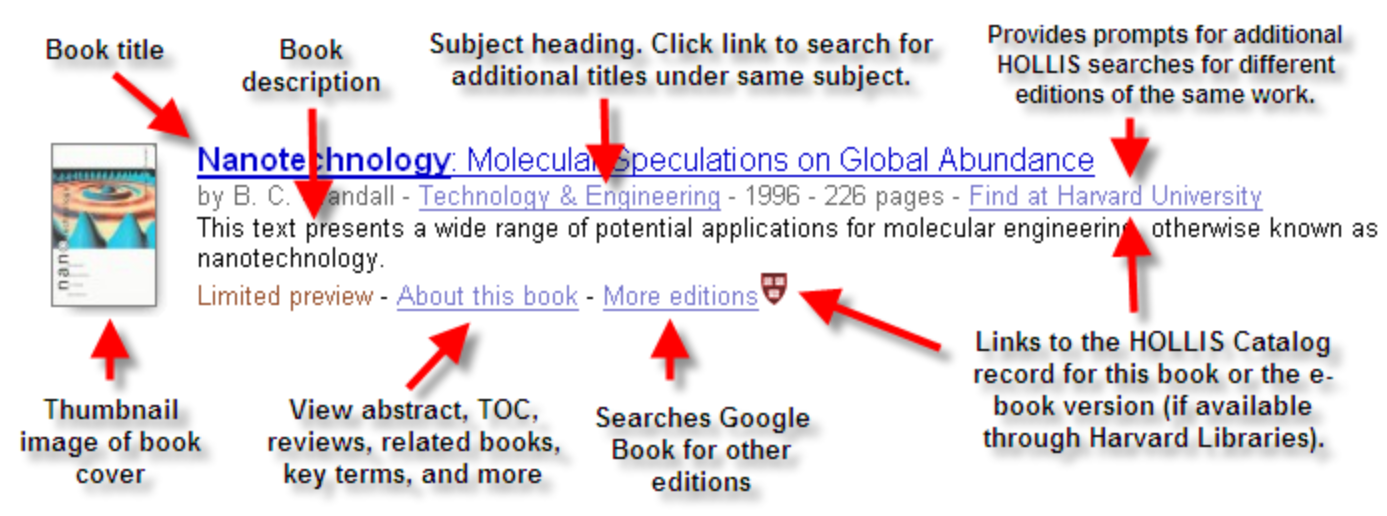

- A typical Google Book Search will yield a series of results - see below for an example with a description of its features

- From the "About this book" section, researchers can read a summary of the book, browse the table of contents (TOC), view references from Web pages, find book reviews, explore other editions, see references to the book from other books and scholarly articles, discover related books, search related key terms, and locate places mentioned in the book via Google Maps. A "Search in this book" window is also featured on the "About this book" section.

- MyLibrary in Google Book Search: If you have a Google account, you can maintain a personalized library of your Google Book searches. This feature allows you to label, review, rate, and full-text search, a customized selection of books. These collections will live online and be accessible anywhere you can log in to your Google account. Once you've built a collection, you can share it with friends by sending them a link to your library in Google Book Search. You can even set up RSS feeds with friends so that they're alerted when you add new books to your collection.

- Only selected books in the public domain (designated "Full view") can be downloaded and printed (It is not possible to print pages in the web view; you must download the PDF)

- Linking to Specific Titles: To link to a specific title, use the book’s International Standard Book Number (ISBN) and insert it in the following URL where indicated: http://books.google.com/books?vid=ISBN{insert ISBN Number here}

Using Google Scholar

- Google Scholar is a special version of Google specially designed for searching scholarly literature. It covers peer-reviewed papers, theses, books, preprints, abstracts and technical reports from all broad areas of research.

- An ID and PIN are required for Google Scholar in order to access the full text of books, journal articles, etc. provided by licensed resources to which a University/Library/Institution/Organization subscribes

- Individuals are able to access Google Scholar directly (without going through an organization) however they will not have access to the full text articles provided by that organization’s licenses

How to do Company Research (prepare for a new job or consulting project)

Source: https://www.youtube.com/watch?v=b3dRHWQ1wqc

- Read the News: Read up on key news of the last 12 months and set up a news alert in Google to always stay on top of the information

- Google News: Search machine from Google specifically dedicated to news

- Google Alerts: Can define a search term and whenever there is a new search result for that term, you’ll get an email from Google

- You should do this for your current employer and client project

- Annual Reports: Annual Reports are some of the richest sources to learn about a new client, they contain key financials, industry trends, recent strategic decisions

- Can usually find these in the “investor relations” section of the company website or by Googling “Annual Report + Company Name”

- Typical contents of annual reports include

- Overall company strategy

- Key business results

- Future focus initiatives

- Industry trends and business risks

- Personnel updates and remuneration

- Financials (P&L, BS, CF, other pro-forma metrics)

- Local company registers: Most companies will be listed in local company registers, research these registers for important insights

- Annual reports are typically only available for large public companies

- Smaller companies need to release business information on a regular basis, and this is where can get access to them

- These have different names for countries, just google “company register

for best results - Reporting obligations depend on size of the company, the larger the firm, the more extensive the reporting requirements

- Typical data available in local registers includes

- Key financials (P&L, BS CF)

- Audit reports

- Ownership structure

- Management team

- Employee data

- Metaregisters combine the information from several of these local country registers which combine all the data (e.g., NorthData.com for EU, can type in the name of a company or person to get all sorts of information on them)

- Industry trends: Educate yourself about the client’s industry by learning about key industry trends (also great for small talk)

- Can type the industry of interest + industry trends in the google search bar and get all types of reports

- Can also use annual reports to get this information and read about what the company itself is writing about this

- This is great because researching industry trends are great icebreakers (e.g., if working in the construction industry and there is a huge shortage of wood, you can bring this up at the initial meeting and ask the client how this trend is affecting his business—this will portray you as knowledgeable to the client)

Beginner's Guide to Business Research

Source: https://sba.ubc.ca/business-basics/beginners-guide-business-research

- Take a deep breath

- Research is time-consuming work

- Quality resources requires the consultation of many different information sources

- Give yourself plenty of time

- Divide your work into small, manageable pieces

- Three areas of research required to formulate a business plan

- Your industry

- Your competitors

- Your customers

TIP: How to generate keywords to search databases

Before you access the resources and databases below, it is best practice to consider the key words you can use as search terms to find information about your industry. Follow the steps below:

- Pinpoint the main words/phrases that describe your industry. (i.e. "bar")

- Brainstorm several alternative words/phrases that will bring you additional search results. These may be direct synonyms, or tangentially related. (i.e. "pub," "nightclub," "drinking place," "tavern," "restaurant.")

TIP: How to use NAICS codes

At the start of your research, it may not be clear what specific industry you should be examining. A good strategy is to find out if your business idea is classified in an industrial classification system. These systems organize industries by assigning them a numeric code. The most commonly used system is the North American Industry Classification System (NAICS). Once you know your Industry Classification Code you can use this number to:

- Find industry-specific statistics on government websites or in library databases

- Generate lists of competitors in company directories

Another common classification system is the Standard Industry Code (SIC). NAICS have most replaced the SIC, but the SIC is still used by some commercial databases. Finding and using these classification systems to effectively search can be tricky, so don't hesitate to ask a librarian for help.

Search or browse all NAICS or SIC codes on the NAICS Association website. Some NAICS codes are different in Canada, you can search by keyword or browse Canadian NAICS codes at Statistics Canada or Canadian Industry Statistics. To search for a SIC code using a NAICS code and vice-versa use the NAICS & SIC Crosswalks.

Industry Analysis

- What is industry analysis?

- An industry analysis is a marketing process that provides statistics about the market potential of your business products and services. This section of your plan needs to have specific information about the current state of the industry, and its target markets. An industry analysis may contain reference materials such as spreadsheets, pie charts, and bar graphs in order to represent the data.

- Step by step checklist

- Identify your industry and provide a brief overview

You may need to explore your industry on a local, regional, provincial, national, and/or global level. Be sure to define relevant industry codes. Provide statistics and historical data about the nature of the industry and growth potential for your business, based on economic factors and conditions. - Summarize the nature of the industry

Include specific information about growth patterns, fluctuations related to the economy, and income projections. Be sure to document recent developments, news, and innovations. Also, discuss marketing strategies, and the industry's prevalent operational and management trends. - Provide a forecast for your industry

Compile economic data and industry predictions at different time intervals (5, 10, 20 years). Be sure to cite sources. Note: the type and size of the industry will determine how much information you will be able to find about a particular industry. Define if it is new and emerging, growing, maturing or declining. - Identify government regulations that affect the industry

Include any recent laws pertaining to your industry, and any licenses or authorizations you would need to conduct business in your target market. This section may include information about fees and costs involved. - Explain your unique position within the industry

Once you have completed your Competitive Analysis (in the next section) you can list the leading companies in the industry, and compile an overview of data of your direct and indirect competition. This will help you communicate your unique value proposition. - List potential limitations and risks.

Write about factors that might negatively impact your business and what you foresee in the short-term and long-term future. Outline what you know about the driving forces: new regulations, technology, globalization, competitors, changing customer needs. - Talk to people!

Go to tradeshows, do cold calls, talk to people in relevant associations and go to business events

- Identify your industry and provide a brief overview

Business research resources

- Trade Publications, Journals, and Magazines: Industry and trade associations work to keep people within an industry informed about the industry through newsletters, magazines, and trade fairs. The information can range from a detailed focus on a specific product line, to general coverage of an industry or key business risk and trends. Industry and professional association websites can be excellent sources of free information whether or not you are a member of that organization. In addition, you can find news about industries via government websites, news databases, as well as news directories and search engines.

- Ulrichsweb: Provides publisher information on more than 300,000 periodicals of all types. use this to create a list of relevant ones to check out in your industry. Search by keyword, publisher or geographic location.

- Trade Associations: Trade associations often publish free industry newsletters that are excellent sources of information for your business plan. Such newsletters often have articles that cover in-depth topics on business management, manufacturing practices, how-tos, current industry news and much more. One good reason to create a list of relevant associations is to see if any of them publish a monthly industry newsletter on their website.

- ASAE Gateway to Associations Directory

Use this directory to search for an association by name, interest area, or international geographic location (including Canada and BC). You can also search using a combination of various fields. - Associations Canada

This library database covers Canadian, as well as some international, industry, professional or special interest associations. Searchable by type or keyword. You can use this to identify key associations' websites and search for freely available newsletters, blogs or reports they they may publish on your industry. Please contact your local public or research library for access. Use of your library card may be required for online access to this resource. Print copies may also be available for in-person users. - Web searching tip: Use Google or another search engine to search for industry associations relevant to your industry in your location. If you don't find a relevant industry association, try broadening your geographic area (e.g. from Vancouver to British Columbia, or from Canada to the U.S. or international). If your industry is very specialized or new, look for associations for broader or similar industries.

- ASAE Gateway to Associations Directory

- Government Websites, Including Labour Market Information Sources

- BC Stats | Current reports and statistics from British Columbia's central statistical agency including labour market information, economic statistics and bankruptcies. Start by searching their Industry section and narrowing by industry type or go to the Business, Industry & Trade page to skim all the different business-related topics.

- WorkBC | Find current employment outlooks, labour market information, relevant links, and a geographic representation of the BC workforce. Start by searching your Industry Profile.

- Innovation, Science, and Economic Development Canada

Provides market research, industry statistics, licensing information for intellectual property, and information about doing business internationally. The Industry Canada site features interactive applications such as customizable trade reports, cost calculators, and online business planning guides. You can also search broad Canadian industry statistics. - Entrepreneurship Indicators Database

This database is intended to provide comprehensive business demography statistics and performance indicators for enterprises in Canada. This information is available upon request.

Competitive Analysis

- What is a competitive analysis?

- A competitive analysis compares your company to others in your industry. It is a useful for determining your competitive advantage, and realistically assessing your company's limitations. The goal of a competitive analysis is to demonstrate how well you know the market, in order to convince your audience that your business will succeed over others. Be sure to provide statistical details, and cite your sources.

- Step by step checklist

- List all of your competitors. Explain what they do, where they do it, and how they do it, in detail. Think of your competitors broadly, including those that offer similar products or services, as well as substitutable products or services. Create a spreadsheet and include sales, market share, pricing, profitability, debt, management effectiveness, technological development, productivity levels, growth capacity and marketing tactics.

- Highlight what you can do that other businesses can't do. Describe your market niche.

- Clarify your role in the market. How will your business fill a specific market niche?

- Prove there is a market for your service or product. Make sure you show the size of your target market. This is where you show how well you have researched your market and presented the proof. Remember to cite all of your sources.

- List your strengths and your achievements. Then list your weaknesses and explain how you will overcome these weaknesses.

- Describe your company in detail, including history and present situation. Include information on business structure, ownership, and location of headquarters and branches. Explain the benefits of your location and your plans for the future. Outline all key players and what they do in your company.

Sources

- Financial Databases (EDGAR, Financial Post Infomart, SEDAR, Financial Performance Data)

- Directories

- News Sources: News articles can be great sources for understanding what your competitors are planning, what new products they are launching, and important information on how they structure their organization. A librarian can help you find relevant online news articles. Don't forget that you can also use media sources to research business and industry trends.

- Business Resources at Academic Libraries: Colleges and Universities with business programs will have useful business collections you may be able to get access to through their academic library. Often these academic libraries can provide the general public with access to their collections, which include electronic resources like databases and e-books. For example, they could have alumni or community cards, and can provide temporary "guest" passes in certain situations. Contact your local college or university library to see what they can provide. Please note: you probably will not get access to their electronic resources with remote access.

- Other sources: Annual Reports, Trade Publications, Journals & Magazines, Associations (be sure to check membership directories)

Customer Analysis

- What is a Customer Analysis?

- In many ways customer analysis is the most important piece of your business plan. In order for your business to be successful, you must be able to demonstrate who will buy your products or services. Be sure to identify your customer segments, and how your business will meet their specific needs.

- Step-by-Step Checklist

- Begin with a concise overview of your industry. You can reiterate this from your Industry Analysis.

- Define your prospects on a measurable level. Describe the demographics of your customers including their age, sex, race, occupation, household income, rent vs. own, postal code, population, spending habits and number in household, where they are located, etc. Be sure to cite all of your sources.

- Describe changes over time and projected changes in the future.

- Describe your customers' behavior. Consider how they make decisions and who in the household makes which decisions. Determine whether they respond to price, loyalty, quality, technology, reliability or trends. Divide your market into segments, assign value to each segment, and decide how to best approach each segment. Be sure to cite all of your sources.

- Use your Competitive Analysis to provide an overview of your competition.

- Use this information about your industry, customer prospects and competitors to identify gaps in the market.

- Identify partners through the same research methods used for your industry analysis.

Find Demographic Data

Census Profile - Statistics Canada

Provides Canadian community profiles from the latest Census of Canada. These profiles are very useful for comparing statistics on different municipalities or regional districts. Includes details on family characteristics, primary language, mobility, educational attainment, marital status, labour force activity, earnings, and mode of transportation to work.

Census Data

Market Research Handbook - Statistics Canada

Socio-Economic Profiles - BC Stats

GeoSearch - Statistics Canada

Public Opinion Polls

Gallup

Ipsos

Note: If possible, it is an excellent idea to conduct some primary market research on your customers. You can conduct focus groups, customer satisfaction measurements, field testing, etc.

INF2325: Launching Information Ventures

Source: https://guides.library.utoronto.ca/inf2325/sources

Selection of secondary market research sources including: Market research reports, Customer or user group data, Industry information, Competitors and company information

Market research reports

Market research reports can help you assess the size and shape of business opportunities, including trends and forecasting. These resources are not considered academic but are rather endorsed within the business community.

Current and archived news, business and company information worldwide.

Global Market Information Database: Reports

Search Euromonitor reports by industry or by country. Industries focus on consumer products from Alcoholic Beverages to Toys and Games. Consumer demographics include lifestyle, income, population, and technology and media usage.

Find research reports on Service Industries, Consumer Goods, Demographics, Food & Beverage, Heavy Industry, Life Science, Public Sector, Technology & Media. Publishers include Kalorama (for health technology), Packaged Facts (consumer packaged goods) and SBI (energy) among others.Note: MarketResearch.com Academic does NOT have all the content available in the full Marketresearch.com site.

Venture capital and private company database tracking deals, companies and investors from seed funding through to exit. Also includes industry analytics by sector, industry and geography, and premium research reports. Global with US emphasis. Find startups and private companies within a particular sector or industry, or search by investor. Requires creation of a free account.

Demographic and customer/user information

Mapping tool contains Canadian demographic data including census, health, household spending, and health and lifestyle. Requires (free) personal account creation to save your research.

Categorized into 21 market sectors, Statista.com provides direct access to quantitative data on media, business, finance, politics, and a wide variety of other areas of interest or markets.

CANSIM (Canadian Socio-Economic Information Management System) is Statistics Canada's database of Canadian social and economic statistics. Includes price indexes that can be helpful when pricing a product or service. Data ends at 2012.

Industry research

Canadian, US and global industry profiles organized by NAICS code and including key statistics, market share and segmentation, performance summary, SWOT analysis. Particularly strong in manufacturing sectors.

Over 1,000 global and regional industry reports primarily focused on consumer goods, but also including construction and retail. Prepared by MarketLine.

Identify the sectors and industries attracting the most and biggest investment using the Industry Heat Map tool. Can search by sector or geography.

Abstract and citation information for peer-reviewed scientific research, including journals, books, and conference papers.

Industry benchmarks to measure the performance and productivity of a company against others in the same field and region/country. Searchable by NAICS code.

Company and competitor research

Companies may be competitors, potential customers, partners or an exit strategy. Search company profiles in the databases and directories below, or jump to information resources for Annual Reports and Regulatory Filings.

Find startups and private companies within a particular sector or industry, or search by investor. Requires creation of a free account.

Venture capital and startup data searchable by company, individual, location, market sector. Accessible salary data and valuation data.

Detailed investment information on startup companies, executives, and investors in Canada and globally. Search the Business Graph to link them all together.

Detailed company profiles including business overview and history, financial statements, annual reports and ratios. Large public Canadian companies are covered.

Full-text company reports written by analysts at leading investment banks, brokerage houses and consulting firms.

Other sources of market research

In most cases, your team will need to search other sources available on the Web as well as library databases.

One strategy involves going directly to potential sources of data or insight, rather than relying on keywords to surface relevant content. Start by asking the question: 'Who cares?' Specifically, 'who cares enough about a topic or issue to collect, aggregate and/or publish data or insight?'

Once you have identified a list of potential sources types, do some additional research to understand specific organizations that may be relevant. Then visit their websites and see what they offer.

Use this checklist of potential sources to start you off:

Strategies for market research

#1: USE GOOGLE THE SMART WAY

We all love Google. It's easy, free, and can yield lots of relevant results.

Remember, however, that Google is not a perfect search tool. It offers:

- limited filters for refining your search, in comparison with most databases

- no control for quality, e.g. peer review filter

- limited ability to remove duplicate content

- can't surface content tied to a (free) account or registration or located behind a paywall

Your venture should be using Google AND a selection of library databases to ensure a comprehensive search.

#2: MIND YOUR LANGUAGE

Databases are very literal - input determines output!

Before you search, generate a list of keywords for the key concepts associated with your startup that you are researching.

Think about the following when developing a list of keywords to use in your search strategy:

- Synonyms: alternatives to your key concept term(s) (e.g. 3D printing = additive manufacturing)

- Acronyms: abbreviations (e.g. CRM = customer relationship management)

- Related concepts: broader terms. narrower terms, related terms (e.g. renewable energy, solar energy, photovoltaic solar energy, alternative energy, green energy, photovoltaics, PV, converters, generators)

- Word variants (e.g. singular vs plural)

- Spelling (e.g. CDN vs US, hyphenation) (e.g. 3-D vs 3D)

As you search, scan your search results for additional keywords for your list. Get in the habit of taking these keywords down so you can retrace and adjust your search strategy as you learn more.

COMMON KEYWORDS IN MARKET RESEARCH

This is a list of keywords associated with market research. While not comprehensive, it can be used to help you develop a search strategy.

- Competitor(s)

- Major players, key players, big players

- Forecast(s)/forecast(s), outlook, projected/projection(s), prediction(s)/predicted, trends, etc.

- Market share(s), share of market, market penetration, market potential, market size, market growth, CAGR, etc.

- Sales, revenue(s)

- Volume, units

- Sold, shipped/shipments, trade/traded, export(s)/exported, import(s)/imported

- Customer or user attitude(s), behavior(s), sentiment(s), preference(s)/preferred/prefer(s), adoption/adopt(s)/adopted, retention/retain(s)/retained, churn, acquisition/acquires/acquired

- Price/pricing, expenditure(s), cost(s), spending, premium(s), freemium

- Time, rental(s), subscriptions, visits, use, business model(s)

- Value(s)/valued, valuation(s)

- Market segment(s), customer segment(s), segmentation

Customize your search question

How does Google work?

Google works by indexing full text for keywords and ranking results. Its proprietary search engine lists the pages that contain the same keywords that were in the user's search term. Google selects search results by prioritizing webpages with relevant page titles and headers, as well as frequency of clicks on webpages. Source: Google Inside Search

Note: The focus is on quantity, but remember, the largest number of results doesn’t guarantee the most relevant search results.

Note: Google can't index anything behind a firewall. So proprietary content such as market research or subscription journals won't be found in a Google web search.

Building an effective search

Combine search terms (or keywords) rather than using questions: The question format sometimes works for Google, but it can pull in too many results. Instead focus on building a search using the following tips for Google and many other research databases (e.g., Scopus, Compendex).

Using the Advanced Search & search operators in Google

Look at the "Get More Out of Google" infographic for the full details

Google Advanced Search: https://www.google.ca/advanced_search

- Combine keywords with connectors

- OR: pull results that include either word [Regulations OR laws OR compliance]

- NOT / - (For Google use the minus symbol - in front of the term): ignore results with that word [driving -school]

- Use quotation marks ( " " ) to limit search to specific words or phrases

- Use around a phrase or concept of two or more words ["trucking industry", "monitor drowsy driving"]

- Allows you to avoid similar terms or derived words and target the exact wording you need

- Be aware that it can mean that you miss out related terms that the search function might identify so you might want to submit search with and without quotation marks

- Search a specific website rather than the entire Internet using site:

- ****Get results from certain sites or domains [compliance site:ontruck.org]

- To get results from multiple sites or domains, combine with OR ["monitoring technology" site:ontruck.org OR site:.gov]

- Search for specific types of websites

- Use different domains to narrow down your search to different types of content sourcesgc.ca [compliance site:ontruck.org OR site:.gov]

- (Canada gov), .gov (Government), .edu (Educational organization), .org (Non-profit organization)

- Search for terms in location on webpage (intitle:)

- Use intitle:term to restrict search results to documents containing term in the title.

- For example, [trucking intitle:compliance] will return documents that mention the word “compliance” in their titles, and mention the word “trucking” anywhere in the document (title or not).

- Search for particular types of documents (filetype:)

- Specify the file type that your require (.xlsx, .pptx, etc.) and be sure that this is no space between colon and file type, [filetype:pdf, OR filetype:doc]

Filter your results

- Click on "Tools" and click on "Any Times" to open drop down menu options (e.g. past year, custom range)

Other search tips?

- What kind of information can you pull from the resources to continue your research?

- Look for academic articles, companies websites (potential competitors), professional associations, data and statistics, etc. Also look for gaps or areas that your company could target.

- What kind of information are you going to need?

- You will need to use particular types of resources for different kinds of information (e.g., demographics, company info, etc.)

- Critically evaluate your results.

- Is it current? Is it accurate? Is it relevant? Is it original?

Don't give up!

If your team's research has identified reports that look useful but which are not available through a library database or on the public Web, don't stop there.

You may be able to find a summary or key statistics in a press release or article linked to the release or publication of the reports. Try Factiva or Business Source Premier to start.

The Practical Rigor of Management Consulting: Methods, Frameworks, and Impact

Research Methods Used by Consultants

Management consultants typically take two approaches to research:

1. Qualitative (phenomenological). To gather necessary data, this approach uses:

- ethnography (participant observation)

- interviews (structured, semi-structured, and unstructured)

- ground work (reviewing existing documentation and reports).

2. Quantitative (empirical). To gather necessary data, this approach uses:

- surveys and questionnaires

- experiments (for example, quasi-experimental design)

- business process modeling and simulations to model data, enterprises, and their operations.

In reality, as more firms pay scrupulous attention to delivering concrete results through improved systems and processes, management consultants must deploy both epistemological approaches and use a mix of research methods.

How consultants do industry research

Source: https://www.consultantsmind.com/2012/05/12/research/

- Management consultants need to be quick learners.

- Junior analysts are routinely asked to support proposals and projects across different industries.

- The good ones are fast, and proficient with Excel and PowerPoint. The great ones get up-to-speed quickly on the industry dynamics and can add in industry specifics to the pitch.

- If you are not proficient at industry research, you will not be a generalist consultant for long.

So what happens if a partner asks you to help on a proposal for something you know nothing about? For example, how do you get smart on commercials trucks?

- Start with Standard and Poor’s (S&P) industry surveys. If you have access to these analyst reports through your work or university, start here. It is loaded up with charts, tables and graphs to get you up-to-speed on the major trends, value chain, competitors, key financial drivers and earnings.

- Download SEC filings and investor presentations. After finding out who the main industry players are at www.finviz.com, go to to the investor relations section of the website. Download the 10-K and annual report. Also, download the presentations made to investors and Wall Street analysts; it is a treasure trove of information on the company’s strategy, and marketing.

Example #1: PACCAR: From this example (company has since taken down the link) you can see that one manufacturer segments the customer base into six groups: 3 of them by size (large, medium, owner operator), 2 by ownership type (leasing vs. private fleet), and also the vocational segment.

Example #2: Navistar: In this Q1 2012 earnings presentation, the management team shared their financial forecast, manufacturing strategy and market share by product type. In the slide below, it shows a worsening market share trend, so you probably want to also listen to the webcast, where management answers tough questions from analysts. - Search for industry trade organizations websites. Look at industry trade group websites to get a summary of trends, and regulatory issues. These groups do an excellent job of simplifying the story for non-experts. In the Google search box, simply add “site:org” to whatever search terms you use. Here are some of the websites that came up from the search for “trucking” and “site:org” American Trucking Association International Organization for Motor Vehicles Manufacturers Truck and Engine Manufacturers Organization National Tank Truck Carriers

- Compare financial metrics. It always helps to compare the financials of different companies to see the 80/20 breakdown of revenue and profits for the industry. Finviz is a great tool, but so is SmartMoney. As you can see in the graphic below in gray color, Smart Money ranks the different companies by market capitalization, revenues, earnings, profit margin, dividends, ROA, ROE etc.

- Don’t forget about blogs and forums. If you are looking for more qualitative information, it is useful to spend 15-20 minutes looking at industry blogs. Just type in “blog” or “forum” with your targeted search term. Then search the specific topic on the blog. If is much better for you to learn the basics from an online blog community, rather than asking your client a question that shows your ignorance of the industry.

- Look at Linkedin.com. Go to LinkedIn and see what current or previous employees are putting on their profiles and descriptions of projects. In the past, I did a market sizing from the tidbits that marketing managers mistakenly left on their LinkedIn profiles.

- Prepare for primary research. There is only so much that you can get online. Think through your questions, then start reaching out to people you know via LinkedIn contacts or undergrad / grad school alumni. Sometimes a 30 min conversation with a subject matter expert is worth 3 days of online research. Potential interviews might be: Suppliers or customers (up and down the value chain) Distributors or dealership owners Former employees Industry researchers or professors.

-100 There are so many other ways to do industry research, but you need to start somewhere. Next steps might be: trade magazines, conferences, government and industry data sets, product reviews, surveys, focus groups, interviews.

Member discussion